Get the free c 159d

Get, Create, Make and Sign 159d form

Editing form c 159d online

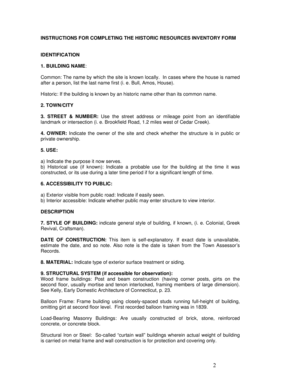

How to fill out nj c 159d certificate of dissolution form

How to fill out 159d?

Who needs 159d?

Video instructions and help with filling out and completing c 159d

Instructions and Help about c 159d form

Hi there I'm going to show you how to start a corporation in New Jersey, so all filing will be done with the Department of State and you can file through the mail or online just to get started here we recommend that filers first perform a business entity search of the Department of State name database to see what business names are currently on file and this is necessary to check the availability of your chosen business name if you file with the name that's already in use your application will likely be rejected, so it's really important to check the availability beforehand you may also reserve a name for 120 days prior to filing by filing the name of the excuse me name reservation application located here so with the name chosen the actual filing process will begin and as you can see we have two links here one for domestic corporations one for foreign so click on the link that corresponds with your jurisdiction of formation, and basically you'll be taken to a tutorial a more in-depth tutorial where you will follow our step-by-step instructions on the filing procedure if you're going to be filing online it's really straightforward you will access the Department of State website submit your filing information and pay a filing fee we have the filing fees listed in the first paragraph here if you were going to be filing through the mail you will need to download a PDF application and submit it through the mail to the Secretary of State office or excuse me the Department State Office with the address located here, and you can pay this fee if filing through the mail by check or money order made up to the Treasurer state of New Jersey, and it's also important to note that foreign applicants must also include a Certificate of Good Standing from the initial jurisdiction of incorporation for filing that's if it's really straightforward a couple of things to mention before I sign off that in the tip section here we have three important things to mention the or employer identification number is a number issued by the IRS to all legitimate taxpaying entities in the United States and this is necessary if you plan on hiring employees registering for bank accounts or performing any financial transaction as a business, and you can apply for this for free either online or through the mail click on this link here for more information on that on the corporate bylaws document the document that can help you strengthen the organizational structure of your business it can define a number of provisions that were left undocumented during the initial registration formation process so if you'd like to look at that we have provided a free template in both Microsoft Word and I told you PDF formats which you can download by clicking on this link here and lastly all corporations will be required to file in a renewal application with the Department of State and this will be filed annually as written here it'll have to be filed no later than the last day of the calendar month...

People Also Ask about

What is Form 159 for SBA?

What is a SBA 912 form for?

What is a 159 form?

How to fill out SBA 1919?

What is the SBA form 1920?

What is a SBA Form 1919?

What is a 1919 tax form?

What is sba 1920?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 159d?

Who is required to file 159d?

How to fill out 159d?

What is the purpose of 159d?

What information must be reported on 159d?

How can I send c 159d form to be eSigned by others?

Can I create an electronic signature for the c 159d form in Chrome?

Can I edit c 159d form on an iOS device?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.